Mexico: Nearshoring, Foreign Investment Create Industrial Opportunities

COVID-19 drew greater attention to this growing market where the fundamentals are strong.

Industrial real estate emerged as a clear winner during and after the COVID-19 pandemic thanks to increased demand for e-commerce, a new emphasis on nearshoring and greater investment in logistics solutions.

In particular, Mexico, with its proximity to the U.S. consumer market, has seen substantial growth in industrial development in recent years. The Mexican Association of Industrial Parks, known by its Spanish acronym AMPIP (for Asociación Mexicana de Parques Industriales Privados), has worked with NAIOP since 2006. It is the leading organization providing support and resources for industrial owners, investors and developers in Mexico. AMPIP’s deep knowledge of the Mexican market may be of special interest to U.S.-based investors who seek new opportunities in 2023, and it can also serve as a resource for the exchange of ideas related to sustainability and energy solutions for a new generation of industrial parks.

Market Overview

Although notably smaller than the neighboring U.S. market, which has 14.5 billion square feet of industrial property, the Mexican industrial market benefits from strong fundamentals and continuing positive trends. According to research from JLL, Mexico’s industrial market encompasses 908.5 million square feet across all product types, including manufacturing. It has seen year-over-year decreases in vacancy, along with increases in rental rates and continued positive absorption. Research from Datoz, a leading Mexican provider of data on commercial real estate, shows that during the first three quarters of 2022, total industrial space construction in Mexico hit a historic level of 43 million square feet, which is 60% higher than the same period in 2021.

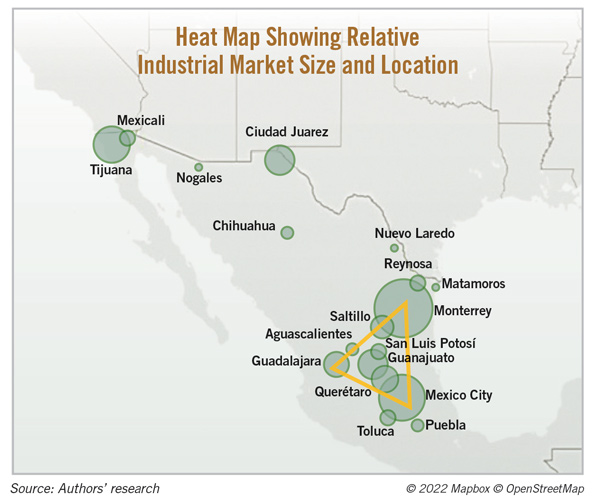

In 2022, 65% of Mexico’s industrial space construction was concentrated in just four cities — Mexico City (20%), Monterrey (19%), Ciudad Juarez (16%) and Tijuana (10%), the last three of which are states that border the U.S. and have greatly benefited from nearshoring. As a result of increased demand in specific geographic areas, particularly in markets like these along the U.S. border, land scarcity may present challenges in the future. However, it may also create opportunities for expansion into new markets.

The largest concentration of industrial properties is in an area called the “Golden Triangle,” bounded by Monterrey in the north, Mexico City to the south and Guadalajara to the west. This area accounts for more than 60% of the industrial space in Mexico.

Within these areas, most industrial properties are located in private industrial parks, the majority of which are AMPIP members. These private parks can usually address many of the market challenges encountered in Mexico, such as a lengthy process to consolidate fractured land ownership, the need for extensive negotiations to provide reliable infrastructure, improved compliance and governance, and the opportunity to provide smart and sustainable solutions to investors, tenants or end-users with an ESG (environmental, social and governance) focus.

Many of the flexible solutions developed within the Mexican industrial park model are applicable in many areas of the U.S. For example, in the Southwest and West, the increasing unreliability of power grids can introduce costs and operational threats to industrial owners and tenants. Similarly, the demand in the U.S. for sustainability may benefit from the goals being developed by AMPIP and its members, which are outlined in greater detail in “Road Map to 2030: Towards a New Generation of Smart and Sustainable Industrial Parks,” published in April 2020.

According to AMPIP’s research, the distribution of product type within these industrial parks varies by submarket, but is generally divided between logistics (22%), manufacturing (22%), automotive-specific (23%) and all others (33%). However, an interesting innovation within the Mexican market is mixed-industrial product, such as a blended manufacturing and distribution facility. The possibility of combining different sectors in the same space would seem to fit in with the ongoing development of more efficient global supply chains powered by logistics and automation.

Of the standard product types, absorption related to the automotive sector has been particularly strong, and all data indicates that it will stay strong into the future. According to a December 2022 article in El Financiero, a Mexican publication that reports on the country’s business and financial markets, automotive has an absorption rate of 27%, followed by logistics (18%), electric (13%) and other products and services (42%).

Market Drivers: Foreign Direct Investment and Nearshoring Demand

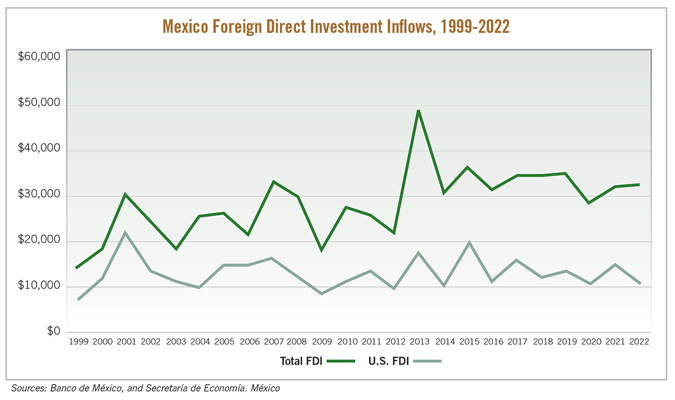

The World Investment Report 2022, published by the United Nations Conference on Trade and Development (UNCTAD), shows that Mexico ranked No. 10 globally as a recipient of foreign direct investment and fifth among developing economies. Additionally, the Ministry of Economy reported that in 2022 Mexico received more than $31.6 billion in foreign direct investment, most of which was allocated to manufacturing.

According to the Inter-American Development Bank (IDB), nearshoring could add $78 billion a year in additional exports of goods and services from Latin America and the Caribbean — $64 billion in exported goods and $14 billion in services. Thanks to the country’s unique nearshoring advantages, IDB estimates that Mexico would potentially achieve up to 55% ($35 billion) of the total estimate of exported goods from Latin America and the Caribbean. This is consistent with the commercial strength of Mexico as the leading exporter in the region. According to Banco de Mexico and the World Bank, in 2021 Mexico ranked as the world’s No. 12 exporter and importer, and was the No. 1 Latin American exporter, responsible for 37.9% of all exports from the region.

The low vacancy rates for Mexico’s industrial properties during the first half of 2022 reflect the strong nearshoring demand for space and is correlated to the increasing level of foreign direct investment in Mexico in the aftermath of the COVID-19 pandemic, which the Bank of Mexico says is expected to reach $35 billion this year. For 2023, companies relocating to Mexico are expected to make significant investments in industrial space — roughly $2.5 billion to build new industrial parks and another $10 billion specifically for the automotive sector, according to a December 2022 report in El Financiero. Monterrey represents the connection between nearshoring, industrial demand and foreign direct investment: not only is it the largest industrial market overall by size, it is also the largest market within the state of Nuevo Leon and a significant destination for foreign investment because of its proximity to Texas.

Strong Underlying Conditions Create Industrial Market Opportunities

Mexico’s status as one of the world’s most competitive countries for attracting investments drives its overall success at creating market opportunities. Six key factors that have a direct connection to Mexico’s industrial market are:

An open economy with access to the most important markets worldwide. According to the Mexican Secretariat of the Economy, the country has 13 free trade agreements with privileged access to 50 countries, which represents 60% of global GDP and more than 1.3 billion potential consumers. The most important of these agreements is the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA and took effect on July 1, 2020. USMCA is one of the world’s largest free trade zones, spanning 495 million people and totaling more than $24 trillion in GDP (28% of global GDP) and $2.6 billion in exports (13.3% of total global trade).

A building within Advance Real Estate’s Puerto Interior industrial park, which is located in Silao in Mexico’s Guanajuato State. Photo courtesy of AMPIP

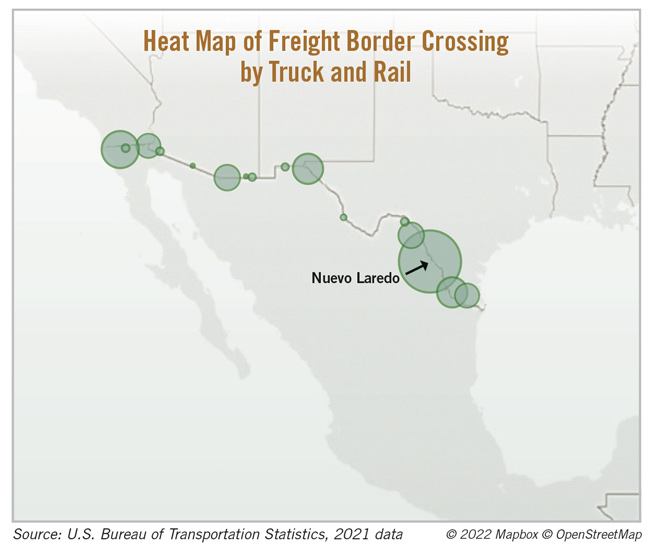

A strategic geographical position relative to the U.S. The approximately 2,000-mile-long U.S.-Mexico border creates abundant opportunities thanks to the U.S. consumer market, which is the largest in the world in terms of spending. While Mexico’s ports and airports are essential for global distribution, rail connections and highways provide critical access between the U.S. and Mexico. According to the U.S. Bureau of Transportation Statistics, an average of 230,000 vehicles and 70,000 trucks traverse the border daily at 56 international crossings, and $56.1 billion in transborder freight moved between the U.S. and Mexico in October 2022 alone. Nuevo Laredo is the most significant cross-border gateway for rail and truck containers, despite having a relatively small industrial footprint as measured in square feet.

Perhaps unsurprisingly, a significant 24% of Mexico’s GDP is generated in the border region. According to Mexico’s Secretariat of the Treasury and Public Credit, the economic activity of the 10 border states of both countries (California, Arizona, New Mexico and Texas in the U.S.; Baja California, Sonora, Chihuahua, Coahuila, Nuevo Leon and Tamaulipas in Mexico) would represent the world’s third-largest economy. Indeed, research from Prologis forecasts a continued increase in market demand in 2023, driven in large part by ongoing trends in nearshoring.

Increasingly skilled workforce. Mexico’s main high-tech manufacturing hubs in Monterrey, Guadalajara and Mexico City have developed a highly trained and skilled labor force. The country also has well-recognized STEM education programs, which graduate an average of 130,000 engineers and technicians annually. Should nearshoring opportunities continue to develop, Mexico could help fill the roughly 1 million information-technology jobs that currently go unfilled in the U.S., according to a March 2021 article from Forbes.

Lower labor costs. Mexico has a plentiful labor supply with an economically active population of 59.5 million, half of which work in the manufacturing and service industries. Relatively low labor costs may remain a primary factor attracting foreign companies to relocate their manufacturing operations to Mexico. For example, according to Statista, Mexico’s average hourly manufacturing labor costs in 2020 were $4.82, compared to $6.50 in China.

The U.S.-China tariff war. Starting in early 2018, the U.S. announced a 30% tariff hike on Chinese solar panels and, by the end of 2019, higher U.S. tariffs affected two-thirds of all imports from China. As a result, Chinese imports were partially replaced by Mexican exporters, according to an October 2021 joint study by the Center for Strategic & International Studies and the Peterson Institute for International Economics. The report estimated that China’s share of the U.S. market fell by 4.12% while Mexico’s share increased by 1.63%. With respect to sales increases, the study estimated that Mexican overall sales in the U.S. rose by 3.4%.

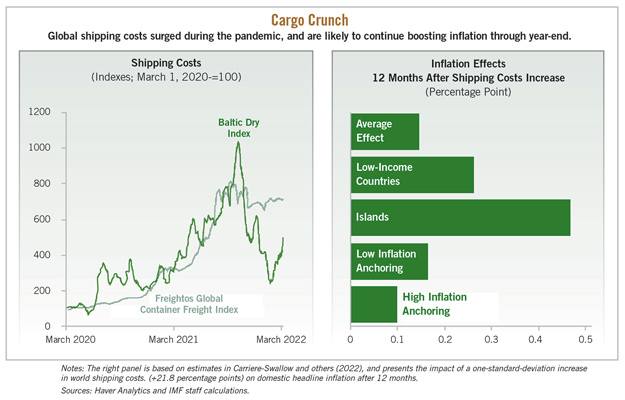

Transportation and logistics costs. A crucial aspect of remaining competitive in the global manufacturing economy is the ability to optimize transportation and logistics costs. Pandemic-related global supply chain disruptions and the higher costs of fuel associated with the war in Ukraine have pushed more companies to consider reshoring from China to the U.S. and Mexico, according to an October 2022 article from Mexico Business News. Similarly, according to the International Monetary Fund (IMF), the result of those supply chains disruptions at a global scale was that “the cost of shipping a container on the world’s transoceanic trade routes increased seven-fold in the 18 months following March 2020, while the cost of shipping bulk commodities spiked even more.” The IMF concluded that the higher shipping costs seen in 2021 continued to impact global inflation by about 1.5 percentage points in 2022.

U.S. vs China as Lead Investor for Nearshoring in Mexico

Rising labor costs in China, persistent global supply chain gaps, the need for greater self-sufficiency in microchip production, and new tensions between Taiwan and China suggest that U.S. companies will continue to relocate from Asia. According to the most recent report from the Reshoring Initiative, between 2010 and 2021, China has been the source of 44% of reshoring cases to the U.S.

These trends clearly underscore why it is important for Mexico to keep attracting foreign direct investment from the U.S., historically the country’s leading foreign investor. Figures provided by the Mexican Secretariat of the Economy illustrate this trend:

- From January 1999 to June 2022, the U.S. invested $308.7 billion in Mexico, which represents 46.3% of the total foreign direct investment for that period.

- 50.4% of direct investment from the U.S. went to the manufacturing sector.

- 54.0% of U.S. investment in manufacturing is concentrated in transportation equipment, chemicals, and the beverage and tobacco industries.

- 48.3% of the accumulated investment in the automotive sector comes from the U.S.

- 96.3% of the accumulated foreign direct investment in the retail trade subsector in self-service and department stores comes from the U.S.

- 71.0% of U.S. investments are in eight states (Mexico City, Nuevo León, State of Mexico, Chihuahua, Baja California, Jalisco, Coahuila and Tamaulipas).

Putting it All Together

The Mexican economy benefits from a robust combination of favorable conditions that continue to attract foreign direct investment and drive growth. Within the industrial property market, economic and labor fundamentals combined with post-pandemic increases in demand have created significant value for industrial developers. As nearshoring trends are anticipated to continue, future opportunities in this market are available for firms with an appetite for international expansion.

C. Kat Grimsley, Ph.D., and Héctor Salazar Sánchez, Ph.D., are professors at George Mason University. Contributing to this report: Claudia Esteves Cano, Executive Director/CEO, AMPIP; Héctor Ibarzábal, Managing Director, Mexico, Prologis; Daniel Quezada, Senior Associate, Mexico Industrial/Logistics Development, USAA Real Estate; Gerardo R. Ramírez Barba, Executive V.P. Industrial, JLL Mexico; and Kim Snyder, President, West Region, Prologis

About AMPIPThe Mexican Association of Industrial Parks, known by its Spanish acronym AMPIP, was founded in 1986. It started working with NAIOP in 2006. AMPIP is made up of private real estate developers, investment funds, real estate investment trusts (REITs), trusts managed by state governments and suppliers related to industrial parks. AMPIP views industrial parks as part of Mexico’s strategic supply chain infrastructure. AMPIP represents:

For more information about AMPIP, visit www.ampip.org.mx/eng/index.php |