Opportunity Zones Aren't Just for Real Estate Development

Main Street and industries also stand to benefit from the new tax incentive.

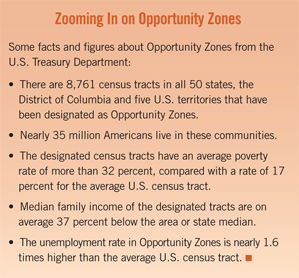

Opportunity Zone incentives offer significant tax benefits to encourage long-term investment in low-income areas. Enacted as part of the tax reform bill that was signed into law at the end of 2017, Opportunity Zones sparked an initial wave of interest among commercial real estate developers, including those focused on affordable housing, office space and mixed use.

However, this early excitement led many in the real estate industry to overlook the fact that Opportunity Zones potentially can be used for any active trade or business. That includes manufacturing, retail, hospitality, medical practices, day care centers, research facilities, energy plants and grocery stores.

What Are the Tax Benefits?

Opportunity Zone tax benefits are available to investors who put capital gains into Opportunity Funds. These funds invest directly in qualifying tangible property or in qualifying businesses operating in Opportunity Zones. Federal income taxes on these capital gains can be deferred until 2026, with a 10-percent exclusion of deferred gains after five years and a total 15-percent exclusion of deferred gains after seven years.

Investing to Spur Growth

Fostering new businesses in disadvantaged areas was an important driver behind the Opportunity Zone legislation, which was intended to create long-term, sustained economic growth and well-paying jobs. Entrepreneurs and innovators interested in bringing economic vitality to an area, as well as investors who want to generate social and environmental improvements plus strong financial returns, can use Opportunity Zone businesses to achieve those goals.

Opportunity Zone Business vs. Direct Ownership

Investing directly in tangible property like a building may make sense for real estate developers. However, holding an equity interest in a qualified industrial, retail or technology business — to name just a few — allows an investor to have a stake in an entire company. That includes tangible assets such as buildings, production lines and machinery, as well as intangibles such as patents and the existing workforce.

In addition to direct investment in tangible property, Opportunity Zone benefits are available when an Opportunity Fund holds an equity interest acquired after December 31, 2017, in a partnership or corporation operating a qualifying business in an Opportunity Zone.

A Qualified Opportunity Zone business could be almost any kind of active trade or business that meets the requirements of the statute with the exception of a “private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.”

Opportunity Funds/businesses share several rules. For example, a property must have been acquired after December 31, 2017; its original use in the Opportunity Zone must be by the Opportunity Fund/business — if that’s not the case, then the Opportunity Fund/business must substantially improve the property within any 30-month period after the property was acquired; and at least 70 percent of the uses of the property must take place within the Opportunity Zone.

Opportunity Zone businesses face additional tests. More than 50 percent of gross receipts must be derived from the active conduct of the business in the Opportunity Zone. Further, a substantial amount of any intangibles held by the business must be used in the business, and less than 5 percent of the assets may be held in nonqualifying intangible property, such as ownership in another business and certain passive assets.

However, investment in an Opportunity Zone business offers notable exceptions from direct ownership in tangible property. That flexibility could make an equity investment even more attractive than direct investment, including for real estate.

For example, only 70 percent of tangible property held by a qualifying Opportunity Zone business must be qualifying Opportunity Zone business property, compared to 100 percent when the tangible property is directly held by the Opportunity Fund. This means that some property can be located outside an Opportunity Zone or acquired before December 31, 2017. The 70-percent rule is good for investors because more businesses will meet the requirements to qualify for Opportunity Zone incentives. (It’s important to note that the statute uses the word “business” to distinguish tangible property from other Opportunity Zone property, including stock or partnership interests.)

A 31-month working capital safe harbor is available to qualifying Opportunity Zone businesses, easing concerns about potential bottlenecks and penalties at the Opportunity Fund level. Because investors must invest capital gains within 180 days, they could encounter problems if the Opportunity Fund isn’t ready to spend down the capital, including running afoul of a rule that requires 90 percent of the Opportunity Fund’s assets to be held in Opportunity Zone property.

Know the Options

Opportunity Zone incentives are resilient and flexible so that investors, developers and entrepreneurs will take advantage of them. While some investors may want to put their money directly into qualifying Opportunity Zone tangible property, others will find that investing in qualifying Opportunity Zone businesses will maximize tax benefits.

Whichever approach is used, investors should use care before making any decisions to avoid costly and irrevocable mistakes that could result in disqualification for preferential treatment of capital gains, as well as the loss of development and new businesses in designated Opportunity Zones.